Accounting treatment of grants received (due)

The legal regulations for accounting grants received (due) have been amended several times in recent years in Hungary. Act C of 2000 on Accounting in effect as of 1 January 2019 was the most recent and at the same time the most important amendment with regard to mitigating the former contradictions in the Accounting Act. Let us take a look at what changed exactly.

Contradiction in earlier regulation

Pursuant to the previous provisions, the accounting of grant income depended on its financial settlement by the balance sheet preparation date or its settlement with the funding organisation. One characteristic of the majority of such grants is that their accounting and financial settlement occur after the costs and expenses are incurred, and often in a different reporting period. It follows that grant income claimed to cover the costs and expenses of a given financial year could only be accounted for in the following financial year(s) pursuant to rules that used to be in effect. This practice, however, was in stark contrast with the principle of matching. Based on the matching principle, when determining the profit or loss for a certain period, the income recognised for the given period’s activities and the costs (expenditures) directly associated with such income must be taken into account, regardless of financial settlement; the income and costs must relate to the period in which they were incurred for economic purposes.

The amendment to the law bears great significance because it partly resolved the above contradiction, since for one of the two types, grants awarded to cover costs (expenses), the rules for accounting income changed. As a result of the amendment, the Act on Accounting allows grant income received as cover for costs (expenses) to be recognised as accrued income if the entity can prove that it will comply with the conditions set forth for receiving the funding, and it is likely that it will receive the funding. Consequently, the accounting of grant income awarded to cover costs (expenses) is no longer tied to the condition of financial settlement or settlement with the funding organisation.

In addition to grants awarded to cover costs (expenses), the other type of support is development grants. In contrast to the former, pursuant to the current Act on Accounting the accountability of grant income from this type of funding is still subject to financial settlement, meaning much stricter rules apply.

What does this mean in practice?

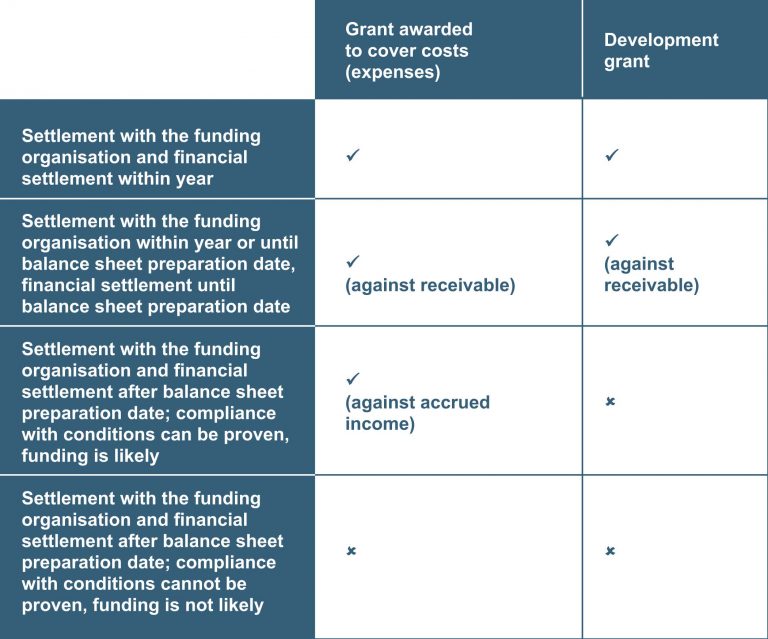

Below we will detail the options for income accounting related to each type of funding in accordance with the prevailing legal regulations, in light of financial settlement and settlement with the funding organisation.

Settlement with the funding organisation and financial settlement until balance sheet preparation date

If the settlement with the funding organisation and financial settlement of grant income to cover costs and expenses take place in the same financial year as the grant is received, then the grant amount may be recognised as other income until no later than the financial settlement, both in the case of grants awarded to cover costs (expenses) and development grants.

Development grants must always be allocated as deferred income pursuant to the Act on Accounting, and released to cover the relevant costs and expenses that are incurred.

If, contrary to the previous case, grants related to costs and expenses incurred in the financial year are settled with the funding organisation in the same financial year, but the financial settlement takes place between the reporting date and the balance sheet preparation date in accordance with the accounting policies, the beneficiary shall recognise a receivable from the funding organisation as of the reporting date. This way, the income can be accounted against other receivables for both funding types. The same also applies for grants awarded to cover costs if both the financial settlement and the settlement with the funding organisation take place at the same time between the reporting date and the balance sheet preparation date.

Settlement with the funding organisation before balance sheet preparation date, financial settlement thereafter

It often happens that the settlement with the funding organisation takes place by the balance sheet preparation date, but the grant is only settled financially after the balance sheet preparation date. In this case, different income accounting options have to be distinguished for the various funding types in accordance with the prevailing regulations:

• For grants awarded to cover costs (expenses), the income is accounted in the way described above, i.e. the income has to be recognised against a receivable.

• For development grants it is not possible to account income since in accordance with the legal regulation referred to above, the financial settlement should have taken place before the balance sheet preparation date. Hence recognising the grant amount as income is only possible in the following financial year, irrespective of whether the funded asset was already commissioned in the given financial year, and the related cost (expense) has already been incurred.

The above clearly shows that in practice the matching principle is not always applicable in relation to development grants.

Settlement with the funding organisation and financial settlement after balance sheet preparation date

In the following case neither the settlement with the funding organisation nor the financial settlement is carried out by the balance sheet preparation date. The significance of the amendment to the law can be indicated most clearly through this example, since previously in such cases, income could not be recorded for the financial year either for grants awarded to cover costs (expenses) or for development grants. As a result of the amendment, however, depending on whether the beneficiary can prove that it complies with the conditions and it is likely that it will receive the funding, it is possible for the entity to record the funding as income in the case of grants awarded to cover costs (expenses) based on the following:

• If the beneficiary can prove compliance with the provisions, and it is likely that it will receive the funding, then the grant awarded to cover costs (expenses) incurred in the financial year can be accounted for as income against accrued income.

• If it is unable to comply with the conditions or it is not likely that it will receive the funding, then the income may not be recognised.

Summary

To sum up, in the table below we will present how to account for grants in the financial year received to cover costs/expenses incurred and investments realised in the reporting year, depending on the approval of the funding claim and the financial settlement for each funding type: